The Modi government came to power in 2014 with the promise of inclusive growth, Sabka Saath Sabka Vikas. In these 9 years of Modi rule most of his promises have turned out to be lies. The promise of delivering a $5 trillion economy by 2024 is a far cry now.

These years have witnessed dwindling growth, high unemployment, skyrocketing prices of essentials, increasing inequality, falling rupee, record bank write-offs, an unprecedented privatization spree and selling off of national assets in the name of monetization scheme, a severe assault on farmers’ and workers’ rights, rising debt, and attacks on small and medium enterprises through the triple assault of demonetization, GST, and an unplanned lockdown.

Growth and Per Capita Levels: Comparing the Numbers.

Narendra Modi was initially marketed as Vikas Purush: a leader who will deliver growth. But what is the reality of growth numbers during the current term of the National Democratic Alliance (NDA) government, (2014-23) in comparison with the period of United Progressive Alliance (UPA) rule? Reports suggests that India’s GDP has grown by 63% in the nine years of NDA rule – from Rs 98 lakh crore to Rs 159.70 lakh crore in constant terms. In comparison, the accumulated growth in the preceding nine years (2005-14) under the UPA regime was 97%.

What is the performance on per capita front during the two periods under comparison? As per reports in 2023, the per capita income growth during the NDA regime after 2014 is pegged at a compound annual growth rate of 4.2 per cent each year. In other words, the real per capita income in 2022-23 is 1.4 times higher than what it was in 2014-15 and it has gone up from Rs 83,091 to Rs 1,15,490 at constant prices with base year 2011-12. Taking the same base year prices, per capita real income during the first nine years of the UPA government rose by 1.5 times from about Rs 50,000 in 2004-05 to around Rs 75,000 in 2012-13, at a compounded annual growth rate of 5 per cent.

Worsening Employment Scenario

India’s unemployment rate in April 2023 was stated at 8.1% as per CMIE data. As per the Periodic Labour Force Survey Report (PLFS) for January to March 2023, the unemployment rate was pegged at 6.8%. As per NSSO 66th round, the unemployment rate was 2.1 % in 2011-12 during UPA regime. In 2018 it rose to 6.1 % as per the PLFS survey report which was released only after the 2019 election results were out and it was then widely reported that unemployment numbers have hit a high of 45 years.

Taxing Petroleum Products at Staggering Rates

The prices of essential commodities are rising consistently. While cooking gas prices have increased to around Rs 1,160 from Rs 400 in 2014, petrol prices have increased from Rs 70-73 to Rs 105-110 and diesel prices from Rs 55-60 to Rs 95-100. This is at a time when, for various reasons, the Modi government has enjoyed the advantage of lower crude oil prices as compared to the earlier governments. It is only of late that the crude oil prices have increased following the Ukraine crisis.

But the government has refused to pass on the benefits of lower crude oil regime to common Indians and has used the opportunity to milk more tax revenues. The government has collected a whopping Rs 30 lakh crore by taxing petrol and diesel at staggering rates during its tenure – collecting more than Rs 1.08 lakh from each Indian household on an average basis. It has shamelessly put the blame on state governments for increased Value Added Tax (VAT) on petroleum products, when it is amply clear that state governments have been left with no option other than taxing petroleum products and liquor after the GST regime came into force.

GST Regime: Taxing the Common Man while Extending Tax Concessions to Corporates

The ‘record’ GST collections every month has been persistently celebrated by the media without realizing that GST numbers are bound to increase every quarter due to inflation. In this year, the budget share of GST collections of the union government has superseded the corporate tax to emerge as the highest source of tax revenue. This has been possible due to increased tax sops to corporates through waivers and concessions, and more importantly, by having one of the lowest tax rates regimes for corporates by global standards. The burden of loss in the revenue due to concession to corporates is compensated by further increasing indirect taxes on the common man.

As per the recent Oxfam report, a little less than two-thirds (64.3%) of the total GST is coming from the bottom 50% of the population, one-third from the middle 40% and only 3-4% per cent from the richest 10% of the country. The bottom 50% of the population at an all-India level pays six times more on indirect taxation as a percentage of income compared to the top 10%. This makes the regressive nature of GST regime crystal clear.

Moreover, the ‘record’ GST collection claim is also hollow and intended to hide the compromising federal revenue character of the GST regime. The state governments which had given up on their constitutional rights of taxes to usher in the GST regime have not been compensated adequately. As per Sacchidananda Mukherjee of National Institute of Public Finance and Policy, the annual average revenue realized from taxes subsumed under GST during 2012 to 2017 was Rs 7.70 lakh crore. If we take this as base from which annual 14 % growth was expected to be realized, the estimated shortfall in the GST collections of states ranges between 19 and 33% for period between 2018-19 to 2022-23. In comparison, the supposed ‘record’ GST collections, if considered as percentage of GDP, persisted at around 6% in period between Q1, FY 2019 and Q3, FY 2023.

Banking and Finance System: Milked in Favour of Corporates

Irrecoverable losses of banks stood at Rs 12,09,606 crores during the Modi tenure, as per letter dated June 15 from Dr. Bhagwat Karad, Minister of State for Finance. Despite this staggering numbers, Nirmala Sitharaman the Finance Minister has been claiming of late that her strategy of early ‘recognition, resolution, recapitalization and reforms’ for non-performing assets (NPAs) has worked and NPAs are under manageable limits now. This strategy has been instrumentalized through the Insolvency and Bankruptcy code. But to find the truth one needs to dig deeper beyond the hyperbole. NPA refers to the non-payment of interest and principal instalment for more than 90 days after it became due. After this regime came into power, and beginning from around 2015, the NPAs suddenly started increasing. The message of compromised credit culture and impunity made the rounds in boardrooms of the corporate world.

But what were the actual recoveries under the supposedly fast process of debt settlements. As per reports in the Business Standard, in first eight years of the Modi government Rs 8.60 lakh crore of NPAs has been pushed under new settlement process and resolution plans have been approved in 480 cases up to March 2022, with Rs 2.34 lakh crore amount realizable by financial creditors. This is around 25 Rupees realization for around 100 Rupees loan. What is the result of these low realizations of Scheduled Commercial Banks (SCBs) Loans? The SCBs which were having total combined profit of around Rs 36 000 crore in 2013-14 went into loss for a substantial period during the Modi regime. The compromised capital adequacy ratio of public sector banks was addressed through recapitalization to the tune of more than Rs 3 lakh crore between 2016-17 to 2020-21. Who ultimately paid for losses and recapitalization of these Public Sector Banks? Naturally the honest depositors and taxpayers. If that was not enough, the guidelines for the settlement process have been amended recently in such a way that 16,000 willful defaulters with debt worth Rs 3.5 lakh crore would also become eligible for compromised settlements. In addition to this, bank frauds have also multiplied under present dispensation, and it has been reported that they stand over Rs 5 lakh crore.

Increase in Government Debt

The government has been unwilling to tax the rich and wealthy to increase tax revenues. The result is that government debt, the combined total of both internal and external debts, is on the rise. The outstanding internal and external debt and other liabilities of the Government of India at the end of March 2014 was around Rs 55,87,149.33 crore which has increased to Rs 152,61,122 crore in March 2023, and is pegged to increase to Rs 169,46,666 crore by March 2024, as per the budget papers of 2023. This is a staggering three times rise in government debt in 9 years. Every Indian has about Rs 1.08 lakh debt on his head. To put this in further context, as per the 2023 budget, out of a total budget size of Rs 45.03 lakh crore, Rs 10.80 lakh crore would only be spent in payments of interest on existing debt obligations. This surely compromises the scope the government would otherwise have to spend on welfare schemes for the people to address poverty and growing inequality. Despite this, the govt has resisted the need to reintroduce wealth tax and inheritance tax and increase tax rates on High-Net-worth Individuals (HNIs). To address the fiscal pressure, the government continues to resort to disinvestment, outsourcing, cutting jobs, subsidies and privatization at a scale never seen before. Another obvious objective of the privatization and outsourcing spree is to benefit the favourite cronies of the government by selling off public sector enterprises and national assets at throwaway prices and granting the cronies lucrative contracts, and in turn they fund the BJP during elections.

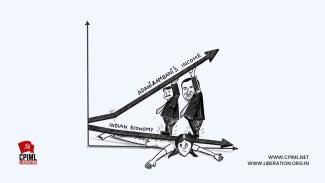

Privatization and Rising Economic Inequality

People were offered only 5 kg of additional ration per month to supposedly address the distress, but favourite corporates were offered privatization, monetization, relaxation in credit and tax concessions on a platter as ‘incentives’ for survival during the covid pandemic. While 84% of Indians suffered from loss of incomes during Covid pandemic, the wealth of billionaires zoomed even during the pandemic and afterwards. India's top 1% owned more than 40.5% of its total wealth in 2021. In 2022, the number of billionaires in the country increased to 166 from 102 in 2020.

The latest Oxfam report points to the large disparity in wealth distribution in India. It states that more than 40% of the wealth created in the country from 2012 to 2021 has gone to just 1% of the population while only 3% had trickled down to the bottom 50%. In 2022, the wealth of India’s richest man Gautam Adani increased by 46%, while the combined wealth of India’s 100 richest had touched $660bn. There is no doubt that these cronies are calling the shots and running the show.

Modi’s tenure signifies crass rise in inequality and cronyism of worst kind. The accelerated neoliberal onslaught has wreaked havoc on people’s lives and livelihood.