The 2011 Occupy Wall Street movement had drawn the world’s attention to mounting inequality with the slogan ‘We Are the 99 Percent’. The Oxfam report tells us that the wealth of the richest 1% has grown faster during the pandemic. Before 2020 the top 1% segment was claiming half of all new wealth, in the wake of the pandemic the proportion has become almost two-thirds, or nearly twice as much as earned by the bottom 99%. Calculated on a daily basis, billionaire wealth has grown by $ 2.7 bn a day. Globally, the richest 1% hold 45.6% of global wealth while the bottom half have to make do with just 0.75%. In India, where the number of billionaires jumped from 102 to 166 in the midst of the pandemic (2020-2022), the top 1% now account for 40.6% of total wealth while the bottom half have only 3%.

For the poor, the economic crisis, described as polycrisis in the report, is felt primarily as a cost of living crisis driven by soaring food and energy prices. For the corporations this has meant windfall profits, defined as a surge of more than 10% above their average 2018-21 net profit. 95 food and energy companies made $ 306 bn in windfall profits, more than two-and-a-half times in 2022 compared with the 2018-21 average. The report has used the term ‘greedflation’ to describe this conversion of people’s pain into corporate profits. While profits have soared for these corporations, escalating prices of essential commodities have pushed over 70 million additional people into extreme poverty in 2020.

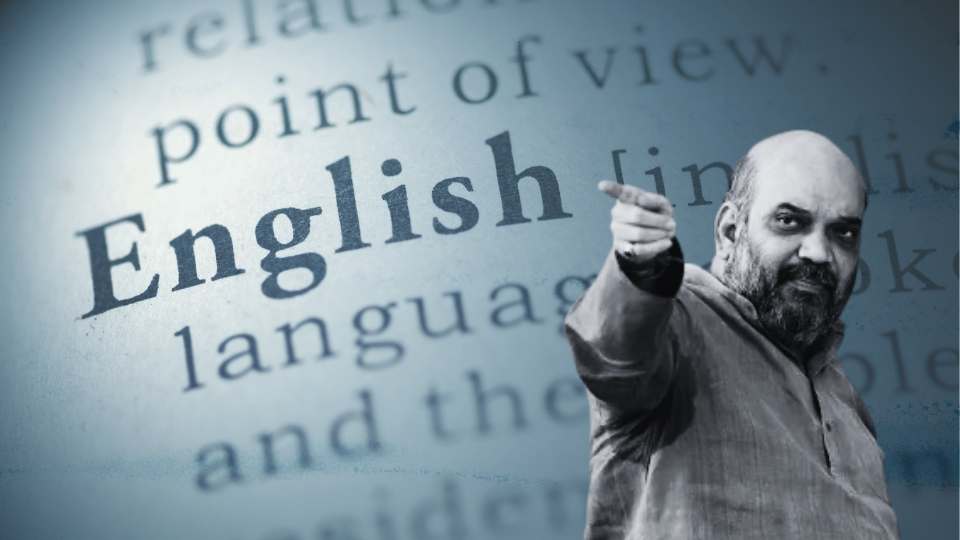

Champions of neoliberal economic policies like Narendra Modi and his ilk across the world want us to celebrate this windfall profit as deserved reward for creation of wealth and wait for this growth to trickle down to the bottom. But the annual inequality reports clearly reveal that instead of growth tricking down we have poverty spreading in the bottom and wealth continuing to accumulate at the top. The instrument of taxation which could have produced some redistributive effect is further aggravating this polarization. The Oxfam report uses an example to drive home this point: Elon Musk, currently the world’s richest person, paid a true tax rate of just over 3% from 2014 to 2018, while Aber Christine, a trader in Northern Uganda selling rice, flour and soya and earning a profit of $80 a month pays a tax rate of 40%.

The report makes a very persuasive case for using taxation to check billionaire wealth and increase revenue to fund welfare expenditure. Taxes on wealth (property tax, inheritance tax and net wealth tax or one-off tax on the wealth of the super-rich) and income (personal income, capital gains and unrealized capital gains), if effectively applied could make a significant difference. The report gives the example of Mukesh Ambani and Gautam Adani to show how nearly 150 bn dollars revenue could be earned just from these two billionaires by levying 5% net wealth tax, 60% tax on dividends and 20% one-off tax on the unrealized capital gains of last five years (2017-22). Tax on unrealized capital gains of Gautam Adani alone could employ more than five million primary school teachers in India for a year while three percent wealth tax on India’s billionaires can fund the National Health Mission for three years.

The case for progressive taxation becomes most urgent in India which is still home to the largest contingent of the world’s poor (228.9 million). But under Narendra Modi, taxes on the rich are steadily going down while the poor have to bear the brunt of indirect taxation through GST. A little less than two-third of the total GST is coming from the bottom 50 percent, as per estimates, one-third from middle 40 percent and only three to four per cent from the top 10 percent. Even as the Oxfam inequality report focuses on mounting inequality, the Modi government boasts of launching the world’s longest river cruise from Varanasi to Dibrugarh where passengers are assured ultimate luxury for fifty one days by paying 300 dollars per head per day. In the context of India, the India story of the global report should actually be rechristened ‘Festival of the Richest’.